How Commercial Teams Can Build a Better Value Narrative

While the true drivers of soaring U.S. healthcare costs are multifaceted and complex, the high cost of prescription drugs routinely dominates headlines and continues to be a focus for most people. According to an August 2023 survey by the Kaiser Family Foundation, 82% of adults think prescription drug costs are unreasonable.

While the true drivers of soaring U.S. healthcare costs are multifaceted and complex, the high cost of prescription drugs routinely dominates headlines and continues to be a focus for most people. According to an August 2023 survey by the Kaiser Family Foundation, 82% of adults think prescription drug costs are unreasonable.

Health insurance companies (payers) often look to pharmaceutical manufacturers to drive lower costs and are scrutinizing each therapy’s value — not only to its target population, but also to subpopulations defined by comorbidity groupings, race and ethnicity, and geographic region, to name a few.

These multidimensional analyses can be challenging, but they also serve as an impetus for a paradigm shift that could greatly benefit all industry stakeholders in the long run. Specifically, Commercial teams can drive organizational changes to ensure the true value of a therapy is captured and expressed. By partnering internally across the product life cycle, a more robust value narrative can be developed — potentially accelerating FDA approvals, market access, label expansions, and, ultimately, commercial success.

Start Here: Shift the Focus From “Cost” to “Cost Savings”

Start Here: Shift the Focus From “Cost” to “Cost Savings”

With comprehensive — and longitudinal — real-world data (RWD), it’s now possible to both measure and project a therapy’s comprehensive and long-term impact, shifting the narrative from “How much does this therapy cost?” to “How much cost does this therapy save?”

The value narrative for Hemgenix is a great example. As a single-use gene therapy, Hemgenix is designed to enable adults with hemophilia B to produce their own factor IX (blood-clotting factor) instead of receiving it via prophylactic therapy infusions. At $3.5 million, it is one of the world’s most expensive therapies. However, Hemgenix showed significant reduction in bleeding events, which, when coupled with all the care associated with this disorder, can cost the healthcare system an estimated $20 million over a patient’s lifetime. Thus, the return on investment (ROI) in terms of health gains, quality of life, and cost avoidance is projected to be nearly 6x.

While pharma typically provides payers with evidence of a drug’s efficacy and short-term impact with the understanding that the cost encompasses research, development, approvals, and deployment, what needs to be shown is the comprehensive value and ROI. This approach works, as CSL Behring noted: "As of May 2023, payers covering roughly 60 percent of the U.S. population have established clear medical policies covering Hemgenix.”

Partnering Across the Organization

Capturing a therapy’s full value — whether that includes a vaccine’s unique benefit to various subpopulations or a gene therapy’s impact over the course of a patient’s life — can be accomplished when an entire organization is aligned from the outset. Commercial teams can help ensure that a robust value narrative is built efficiently by advocating for these three approaches:

1. Prioritize efficiency in evidence generation.

1. Prioritize efficiency in evidence generation.

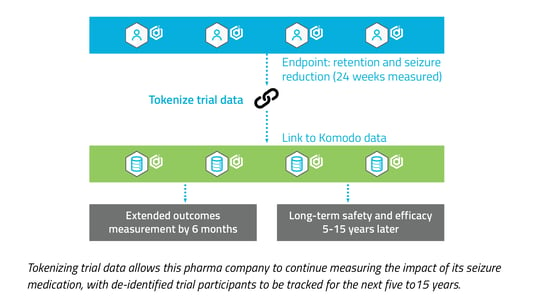

Tokenizing trial data will capture insights well beyond a trial’s endpoints, allowing for the measurement of long-term outcomes and enabling the use of this data to create external control groups. This allows organizations to enrich the value narrative and may prove to be an important component in determining payer coverage. Tokenization also facilitates and accelerates future trials for population subsets, which can help expedite label expansions that lead to even greater commercial success.

.png?width=545&height=350&name=Body%20Mass%20Index%20(BMI).png) 2. Use RWD that enables subpopulation analyses.

2. Use RWD that enables subpopulation analyses.

As pharma companies that have targeted rare disease populations can attest: As the size of a cohort shrinks, the ability to leverage comprehensive data that mirrors the age, gender, race, ethnicity, population size, and geographic regions of the US population becomes imperative. Not all RWD offers this level of fidelity, and as the FDA has highlighted, this ability to investigate subpopulations during clinical development is becoming non-negotiable.

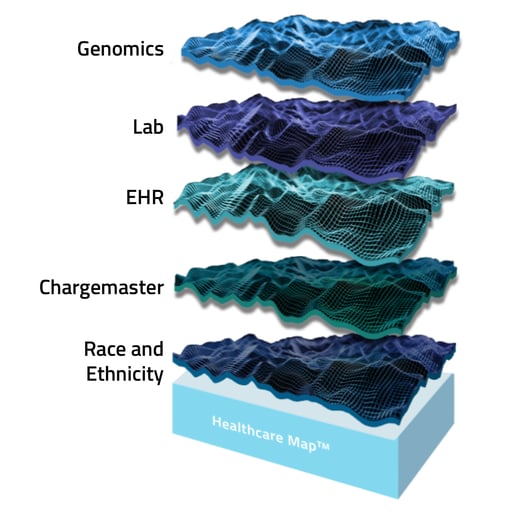

When RWD captures the comprehensive patient journey — across all HCPs, HCOs, care settings, and payers — the accuracy of insights increases exponentially. A combination of longitudinal (closed claims) and real-time (open claims) data sources, particularly when joined with EMR, laboratory, and genomics data, makes this possible.

3. Streamline insight curation.

3. Streamline insight curation.

As therapies become more personalized, there is a more pressing need to break down the silos of disparate healthcare data across EMR, genomics, laboratory, race and ethnicity, and various other sources. There are a multitude of impediments to executing this quickly, efficiently, and accurately while still providing robust context to the patient journey as historically assessed via claims data.

Traditionally, companies have been forced to leverage internal expertise and bandwidth in identifying, acquiring, and integrating various sources, which not only slows speed to insights but also risks data integrity, and thus, confidence in the analysis. Choosing a single data partner that has pre-built access to myriad sources and, further, manages the process of cleaning, de-duplicating, joining, certifying, and delivering a dataset that is ready for insight generation, can accelerate the process by several months and ensure confidence in those insights.

Embrace the Challenge

By helping stakeholders across an organization reframe how a therapy’s comprehensive value will be captured and expressed, Commercial teams can build a more powerful and valuable narrative. In turn, payers and providers will have greater perspective and context of each therapy’s impact on improving health and reducing costs, which can help shift the conversation from “cost” to “cost savings” and — eventually — to “investment.” Ultimately, it’s patients who will benefit the most as more is known about how therapies impact subpopulations and the real cost of a disease.

Learn more about the power of RWD in expanding market access in our article, "How Real World Data Is Transforming Cell and Gene Therapy Commercialization.”

About the Author

Scott Phillips is responsible for evaluating and partnering with data sources to enhance Komodo’s Healthcare Map™ and solution offerings. His prior experience includes helping pharmaceutical and biotech companies develop go-to-market strategies and enhance their clinical research processes through the use of RWD. Scott earned an MBA from Harvard Business School and a BA from Brown University.

To see more articles like this, follow Komodo Health on Twitter, LinkedIn, or YouTube, and visit Insights on our website.