Prescriptions for Trendy Diabetes and Weight-Loss Drugs Increased Over 2,000% Since 2019

Recent shortages in diabetic medications stem from the approval of Wegovy® for weight loss in patients without diabetes.

A social media–driven rise in prescriptions for diabetes medications has been making international headlines. As of February 17, the hashtag #Ozempic had been viewed more than 546 million times on TikTok. Ozempic® and Mounjaro®, two of the drugs in question, are now in short supply as off-label use for weight-loss continues to soar among the general public.

Ozempic, an injectable form of the generic drug semaglutide, was approved by the FDA in 2017 to improve glycemic control in patients with type 2 diabetes. It helps regulate blood sugar and insulin while curbing hunger. Semaglutide is also branded as Rybelsus®, an oral form of the medication. Mounjaro, the brand name for tirzepatide, is an injectable medication similar to Ozempic that was approved for patients with diabetes in 2022. None of these three drugs have been approved for weight management in patients with or without diabetes, although weight loss may be one effect. All labels indicate that they are to be used in conjunction with diet and exercise regimens.

In 2021, the FDA approved a higher-dose version of semaglutide, branded as Wegovy, for patients without diabetes who have high a body mass index (BMI) and at least one weight-related medical condition, such as high blood pressure or high cholesterol. According to an article in The New York Times, high demand for Wegovy has put it in short supply, leading providers to start prescribing the other brands off-label.

Of course, health trends that emerge this quickly come with the risk of unintended consequences. While these drugs can have important benefits, they have not been extensively studied in patients without diabetes or obesity. There are concerns that prescriptions are being written for lower-BMI patients seeking a quick fix for weight loss or whose weight may not impact their overall health enough to warrant the potentially significant side effects and risks these drugs can present — from nausea to kidney failure to quick reversals of progress upon stopping the drug. There are also consequences for people with diabetes who depend on these medications and who are now facing supply shortages.

Using Komodo Health’s full-stack healthcare analytics platform, we tracked prescriptions for these medications in patients with and without diabetes over the past five years. Looking at prescriptions for semaglutide (sold as Ozempic, Wegovy, and Rybelsus) and tirzepatide (sold as Mounjaro) from 2019 to 2022, we evaluated who is getting prescriptions and which providers are writing them. Here’s what we found:

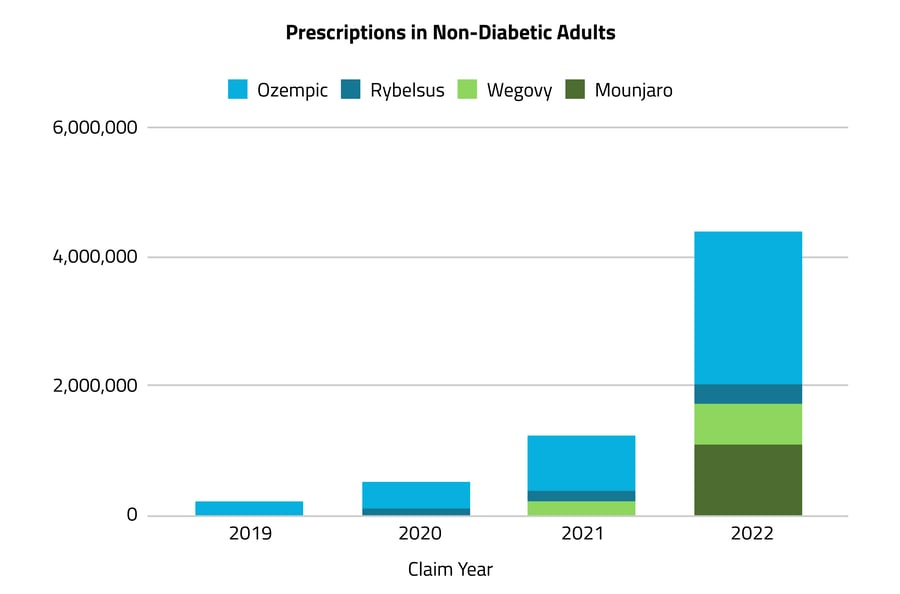

In 2022, more than 5 million prescriptions for Ozempic, Mounjaro, Rybelsus, or Wegovy were written for weight management, compared with just over 230,000 in 2019 — a 2,082% increase.

Prescriptions increased by 259% between 2021 and 2022 alone. Roughly 25% of all prescriptions were written for patients without diabetes, suggesting that at least Ozempic, Mounjaro, and Rybelsus are being more widely prescribed off-label for weight management. In part, some of these increases reflect the timing of when drugs were approved — Rybelsus in 2019 and Mounjaro in 2022. But Wegovy remains the only drug approved for use (in 2021) in patients without diabetes who meet other criteria. Rybelsus is likely less popular in this population because it’s been shown to be less effective for weight loss than its injectable counterpart.

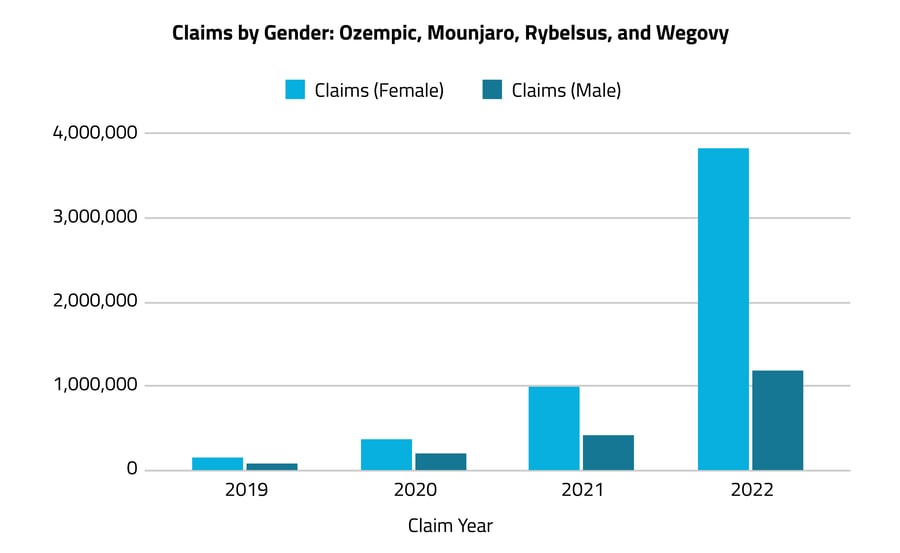

Women ages 45 to 64 were significantly more likely to receive prescriptions.

Among patients without diabetes, more prescriptions were written for women than men. Pre-pandemic, in 2019, women received these prescriptions about 66% more often than men. In 2022, women received them more than three times as often as men. According to the CDC, the overall prevalence of obesity is similar between genders, but women are roughly twice as likely to meet the criteria of severe obesity, pointing to an increasingly disproportionate number of women receiving these prescriptions for weight management in recent years.

Among non-diabetics, more than 50% of patients who received prescriptions were ages 45 to 64 (of which 75% were women), and just under 40% were ages 25 to 44 (of which 81% were women). Seniors aged 65 and older accounted for 10% of patients who received prescriptions, and young adults ages 18 to 24 accounted for just over 2%.

The five states with the highest number of prescriptions for people who do not have diabetes are: Texas, Florida, California, New York, and Georgia. These are also the states with the highest populations. Nearly twice as many prescriptions were written in Texas than in California, even though California has the largest population.

Nurse practitioners wrote the most prescriptions for these medications among patients without diabetes.

Advanced practice providers made up a significant proportion of clinicians prescribing these medications for weight loss in patients who did not have diabetes. Between 2019 and 2022, nurse practitioners were the top prescribing specialists, just above family practice physicians. These were followed by internal medicine specialists, endocrinologists, diabetes and metabolism specialists, physician assistants, and advanced practice nurses.

Komodo Health’s platform unlocks a real-time view of healthcare utilization trends. These insights empower stakeholders to respond proactively to the health concerns and supply-chain impacts these ground-swell trends can cause. In the case of Ozempic and Mounjaro, a sudden demand for off-label usage could pose challenges for patients with diabetes who depend on the drugs for health management and for new patients who may need to quickly identify a course of treatment. Consequences of new health trends must be anticipated and followed closely to prevent any unintended long-term impacts on the health and lives of patients. Real-time analyses such as this offer unprecedented insight into an emerging trend that is shaping the healthcare landscape.

about recent health trends in our new Fast Facts infographics series. This month, we looked into cervical cancer.

about recent health trends in our new Fast Facts infographics series. This month, we looked into cervical cancer.

To see more articles like this, follow Komodo Health on Twitter, LinkedIn, or YouTube, and visit Insights on our website.